Lidar maker Ouster has acquired StereoLabs, a company that makes vision-based recognition systems for robotics and industrial applications, for a combination of $35 million and 1.8 million shares.

The agreement is the latest in efforts toward integration among sensory sensor suppliers. Just last month, MicroVision acquired the much-hyped but now bankrupt LIDAR assets of Luminar for $33 million. Auster itself has been in the M&A game quite a bit. In 2022, the company merged with rival company Velodyne. The year before, the company acquired lidar startup Sense Photonics.

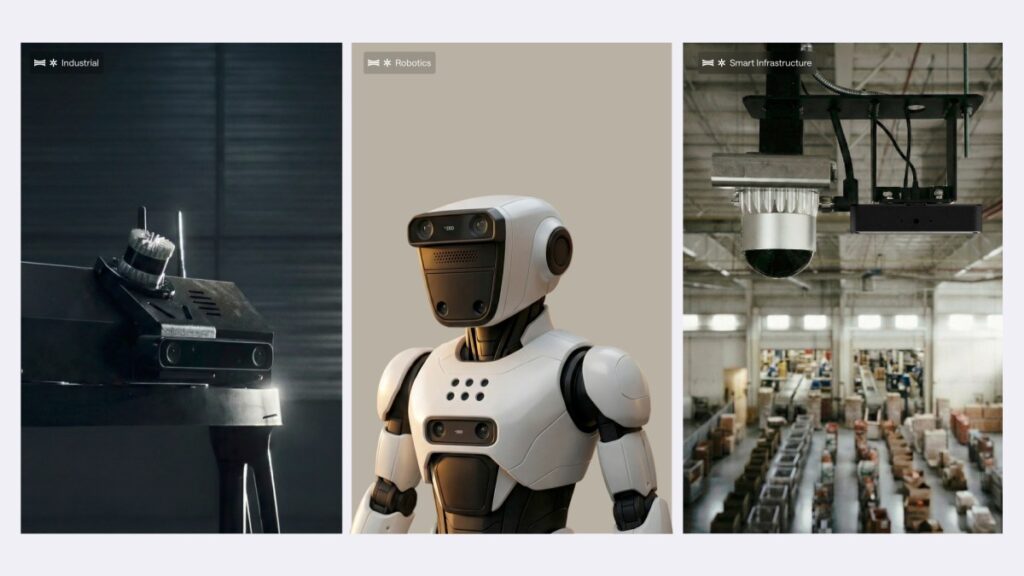

This integration comes just as companies and investors are rushing to build businesses around “physical AI.” Physical AI is a broad term that includes everything from humanoid robots and drones to self-driving cars and automated warehouse systems. As these technologies develop, more unknown suppliers are raising significant amounts of funding. There are even startups launching entirely new sensor methods.

Angus Pacala, co-founder and CEO of Ouster, told TechCrunch that he had been keeping an eye on StereoLabs for years. He said he considers lidar “a core component of a safety-critical, capable system,” but “wants to move up the stack.”

Pacara said the “obvious additional sensor” to start using in addition to lidar is cameras. Pacara said 15-year-old StereoLabs is “best in class” in terms of hardware, but he was especially drawn to how the company is “incredibly adept at deploying cutting-edge AI models and edge computing” to get the most out of these cameras.

In particular, Pacala highlighted the development of StereoLabs’ fundamental AI model that can determine the depth of objects from stereo cameras.

“It was easy for us to go out and approach them and basically sell them this vision of working with us to become an integrated sensing and perception platform, Tier 1. [supplier] It’s perfect for these advanced physics AI systems,” Pacala said.

tech crunch event

boston, massachusetts

|

June 23, 2026

Auster said that despite the focus on integration, Stereolabs will operate as a wholly owned subsidiary.

And despite the hype, Pacara said he didn’t buy StereoLabs simply because physical AI is getting more attention and money. In fact, he committed perhaps the most serious sin in the hype cycle. In particular, it threw cold water on topics related to humanoid robots.

“The business model here is not just selling enthusiasm, but creating a practical system that is actually certified, secure and actually solves problems for customers,” he said. “There’s going to be a little bit of disillusionment with physical AI because it turns out it’s going to take a lot longer to get all these humanoid robots to market.”

Pacala is not alone in trying to be realistic. In a recent interview with TechCrunch, MicroVision CEO Glenn DeVos said the sensor industry is “ripe for consolidation” as he believes there is not enough revenue to support all the current competition.

“Either there will be consolidation, or people will fall by the wayside and be weeded out of the industry,” he said.