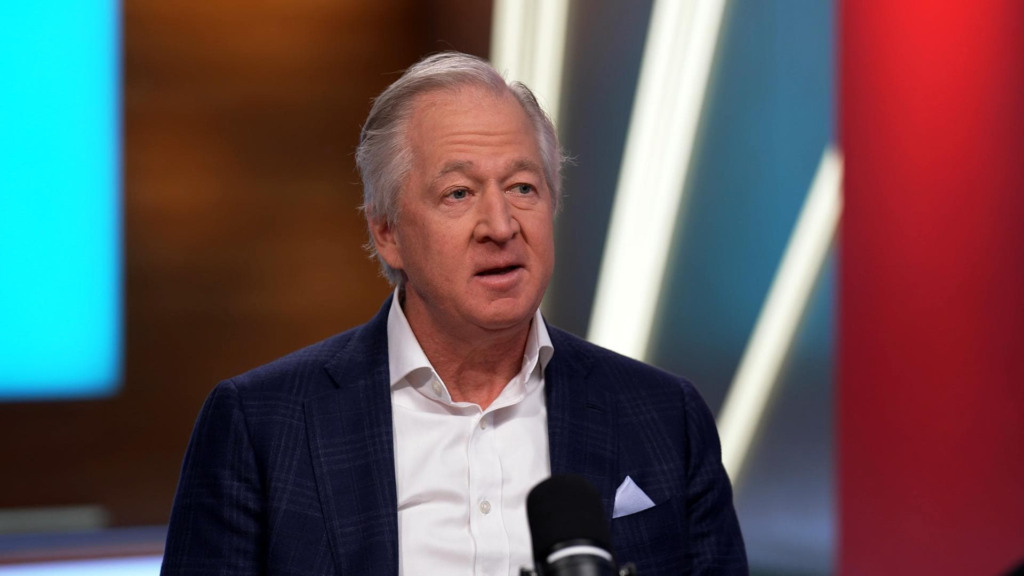

A version of this article first appeared in the CNBC Property Play newsletter with Diana Orrick. Property Play covers new and evolving opportunities for real estate investors, from individuals to venture capitalists, private equity funds, family offices, institutional investors and large publicly traded companies. Sign up to receive future editions directly to your inbox. French building materials conglomerate Saint-Gobain began its business more than 350 years ago by manufacturing mirrors for the Palace of Versailles. Our current focus is on the windows of U.S. homes: windows, walls, ceilings, and other building materials. The company has invested nearly $7 billion in the North American market over the past three years, making it the largest global company. While its previous strategy focused on growth through acquisitions, the company is now investing in organic growth, including expanding existing manufacturing facilities and investing in other facilities. The company has more than 18,000 employees in more than 160 locations across North America and had market sales of $10.5 billion in 2024 (latest available). “We’re doubling down on our business in North America because the fundamentals there are so strong,” Mark Layfield, Saint-Gobain’s North American CEO, told Property Play. “We’re under-building in the residential sector. About 4 million homes need to be built in the U.S. to keep up with population growth, and a lot of renovations are needed in the commercial sector.” Layfield said Saint-Gobain focuses on speed and affordability of construction through materials, assembly and other tools. He pointed to the company’s “One Precision” assembly system. Replace traditional “stick-to-stick” frames with factory-assembled wall, floor, and roof panels. The system accelerates home construction by moving a large portion of the workforce to a controlled indoor environment, allowing parallel processing to simultaneously manufacture panels in the factory and prepare the site. The company says this can reduce construction cycle times by 30% to 50%. It also eliminates common on-site delays caused by weather, labor shortages, and complex trade coordination. “If you’re building a home, or you’re a small home builder, you build 10 to 15 homes a year. With this solution, you can build three times that many homes, because that’s a critical time to frame the home and weatherize it,” Rayfield said. Saint-Gobain’s shift to U.S. production in states such as Florida, Georgia, North Carolina and New York has shielded it from tariffs that have hit many of the country’s biggest home builders. Layfield describes the company’s strategy as “local for local,” but acknowledges that workforce remains a major challenge. “We believe we have to take ownership in developing more talent in construction and manufacturing, and we are doing a lot of work in that area, but there are always headwinds,” he said. Last fall, CertainTeed, a subsidiary of Saint-Gobain, completed a major expansion of its Palatka, Florida, facility, making it the world’s largest gypsum wallboard manufacturing facility. The expanded facility will produce the entire range of CertainTeed gypsum wallboard products locally in the southeastern United States to ensure supply chain reliability. The location will feature both a deep-water port and rail access, providing an efficient logistics hub for a rapidly growing regional market, according to the release. Saint-Gobain has long been committed to building sustainable materials and more climate-resilient homes. Despite U.S. political rhetoric moving away from climate-related goals, Rayfield argues that there is still an incentive to build efficiently because there is no cost difference when using prefabricated systems. All components are designed to work together seamlessly. All you have to do is assemble the system and train your contractors how to build it. And while sustainability may be out of political fashion, resilience is far from it, especially as climate change intensifies weather events. “We need to build fire-proof homes in California, hurricane and flood-ready homes in the Southeast, freeze- and rain-proof homes in New England, and hail-proofing,” Rayfield said. However, he remains committed to using sustainable materials, recycled content and reducing energy in construction and manufacturing. This includes recirculating heat bumps and using electrical and carbon-free energy. “We know we need to make products affordable for our customers, and where we can do it with a lower carbon footprint, we will do so,” he said. “And resilience is key to what we have to do going forward.”