NFU Cymru wrote directly to the Prime Minister calling for a U-turn to a controversial change to inheritance tax rules, as it is causing “pain and distress” among farmers.

The letter is because the government is expected to publish draft tax provisions for the next financial bill against the backdrop of growing concerns across rural communities.

At the heart of this issue is reforms to agricultural property relief (APR) and business property relief (BPR) announced in the fall 2024 budget, which is scheduled to come into effect from April 2026.

Under the proposed changes, the 100% inheritance tax credit on eligible agricultural and business assets will reach £1 million.

Values above that threshold will be counted within the same £1 million limit for both APR and BPR contributions, and will receive only 50% easing.

Policy changes are seen by many in the industry as a direct threat to the future of British family farming.

The looming “family farm tax” has sparked widespread anxiety, especially among older farmers facing complex financial decisions with little time to prepare.

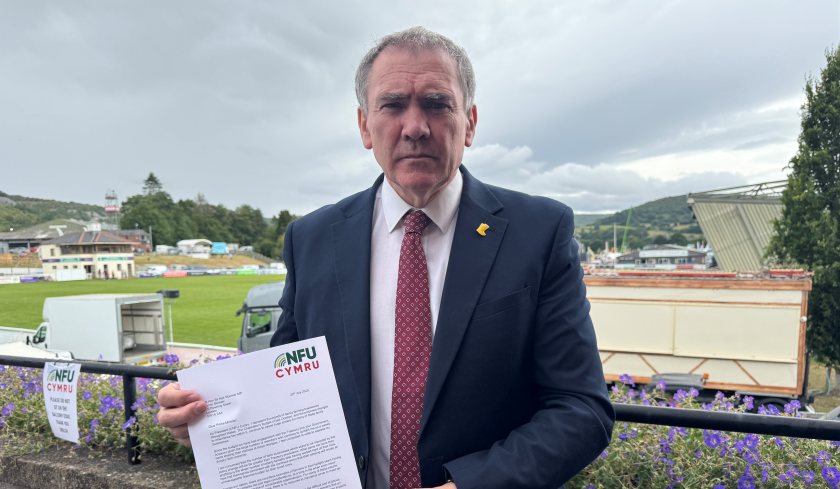

President of NFU Cymru’s Aled Jones said he had no choice but to write a letter to ir Keir Starmer after receiving a pouring of concern from Welsh farmers.

“I was forced to write to the Prime Minister after being contacted by hundreds of Welsh agricultural families involved,” he said.

Jones warned that the number of farms likely to be affected by the inheritance tax change could well surpass Treasury estimates.

“More than anything, I find myself suffering from the number of elderly farmers who have worked hard for their lives to suffer from the ongoing concern that their deaths will bring unruly financial burdens to their loved ones.”

He emphasizes that older farmers with poor health must tackle complex tax and legal issues, often without having to take out insurance that will help them meet future tax bills.

“There are countless examples of farmers in Twilight that have to deal with juvenile tax and legal considerations throughout our country.

“Because of age and health issues, for many of these people, there is no reliance on insurance to meet their tax liability.”

Jones said it was unthinkable for the government to deliberately place elderly farmers in such a “difficult and mysterious position” and urged the minister to reconsider.

“My view is that there is still an opportunity to mitigate the implications of so many people of these policy proposals while meeting the government’s objective of raising revenue.”

Fallout becomes more controversial by the view that many farmers see as a broken political promise. In November 2023, the then Shadow De Fraste Breed MP (now Secretary De Fra) declared at the CLA meeting. “We don’t intend to change the APR,” farmers said that commitment is now abandoned.

The NFU Cymru letter is part of a wider campaign to #StopthefamilyFarmTax, urging farmers to write letters to local lawmakers and explaining the personal and economic impacts of reform.