By Sheila Dan

Hess Takeover is one of the biggest energy transactions in decades that took him to complete the acquisition.

HOUSTON, July 18 (Reuters) – Chevron (CVX.N) closed $55 billion Hes.N on Friday after winning a groundbreaking legal battle with its massive rival ExxonMobil (XOM.N) to access the biggest oil discovery in decades.

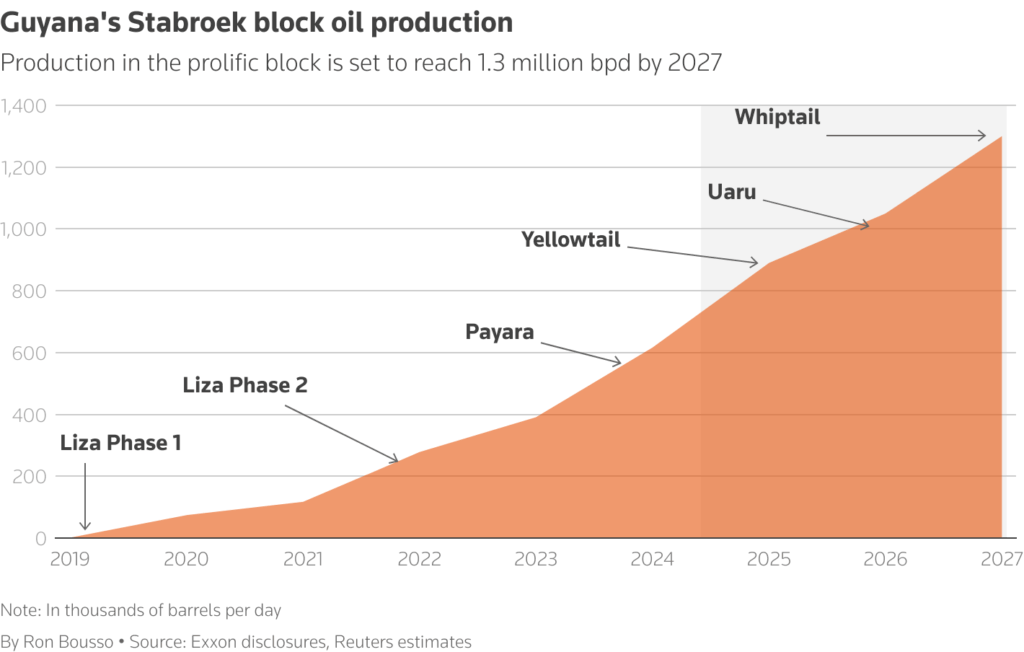

Chevron CEO Mike Worth’s strategy to turn the company’s lagging performance back on the acquisition, one of the biggest energy deals of the past decade. The award is a stake in the rich Stabroek block off the coast of Guyana, which holds over 11 billion barrels of oil and is one of the fastest growing oil states in the world.

“These two great American companies merge together brings together the best in the industry,” Wirth said in a statement.

Guyana’s Hess partner Exxon and China’s CNOOC have filed an arbitration dispute claiming they retained the preemptive right to buy Hess shares.

“We do not agree with the interpretation of the International Chamber of Commerce (ICC) panel, but we respect the arbitration and dispute resolution process,” Exxon said in a statement.

“Given the key values that have been created in the development of Guyana Resources, we believed that there was a clear obligation for investors to consider preemptive powers to protect the value they have created through innovation and hard work when they weren’t sure how successful this venture would be,” the company added.

The CNOOC said it was also disappointed with the ruling.

The International Chamber of Commerce and the courts that oversee the arbitration case have no appeal process.

Even as they waited for the arbitration verdict, Chevron was preparing and could quickly close deals with Hess, Reuters previously reported.

Chevron and Hess information technology workers met regularly to plan the integration, and Hess employees were informed that they could request a retirement package following the end of the transaction.

In an interview with Reuters on Friday, Wirth said it would take months to convert the technology and combine employees from both companies.

Chevron and Exxon stocks were slightly lower in morning trading.

Oilfield wealth

Claims from Exxon and CNOOC have launched a long legal battle that has attracted attention from the global oil industry, shareholders and lawyers creating joint sales agreements that control oil partnerships around the world.

This case demonstrates the value of the Stabroek block, which promotes the interests of an Exxon-led consortium that controls all oil production, transforms Guyana into one of the fastest growing economies in the world, and has the potential to discover even more oil.

Stabroek Block Oil Production in Guyana

The dispute centered on interpreting several words in a confidential joint operational agreement between Exxon, Hess and CNOOC, experts told Reuters.

“It didn’t have to happen like this,” Worth told Reuters. “We were actually engaged in a sincere conversation for months, but when they (Exon) were informed that they were applying for arbitration, it ended abruptly.”

“As I had expected from the start, the results are simple and simple.”

CNBC, which first reported the news of Chevron’s victory, cited an interview with Exxon CEO Darren Woods.

CNBC also reported that Woods said his relationship with Exxon in other projects around the world was OK through arbitration procedures.

“This was by no means about Chevrons. It was about enforcing the contract in the way it was intended,” Woods told CNBC.

Hess’ revenues from Guyana rose from $3.1 billion last year from $1.9 billion in 2023.

Chevron’s adjusted revenue last year went from $24.7 billion in 2023 to $18.3 billion.

Reports by Sheila Dan of Houston and Alnima Kumar of Bengaluru. Edited by Anil D’Silva, Louise Heavens, and Elaine Hardcastle

Share this: