President Donald Trump’s so-called “reciprocal tariffs” could be struck down by the U.S. Supreme Court as soon as this week. Whatever the verdict, there is little consolation for the furniture industry.

Furniture importers were hit with increased tariffs on items such as sofas, kitchen cabinets and vanities last fall under Section 232 of the Trade Expansion Act, and furniture importers are now facing higher, and in some cases, cumulative import duties.

President Trump’s country-specific “Emancipation Day” tariffs, imposed under the International Emergency Economic Powers Act and announced in April, are under review by the nation’s highest court, but the roughly 25% tariffs specific to furniture importers have not been reviewed.

Peter Celan, CEO of the Home Furnishings Association, a trade group representing furniture retailers, said the uncertainty plaguing the industry always exacerbated the problem.

The 25% tariff on some furniture imports was scheduled to rise to 50% in January, but in late December that plan was postponed to 2027. It has also become common over the past year for President Trump to threaten new tariffs on a variety of imports, which were never enacted.

“This is a very difficult time to manage a business,” Teran said. “The biggest source of difficulty in business management is the unpredictability and the inability to make and invest in backup plans because we don’t know what tomorrow will bring.”

growing pain

Tariffs and the uncertainty they bring are the latest blow to the furniture industry. The industry has been struggling for the past four years and was under pressure well before President Trump’s trade war.

When people were stuck at home and running out of cash during the coronavirus pandemic, many Americans took the opportunity to refresh their spaces and buy new furniture and decor. After that, low interest rates led to a sharp increase in demand for newly built homes, which led to the purchase of furniture.

As a result, the entire household goods industry grew significantly and ushered in a furniture boom.

But once inflation and interest rates began to creep up in 2022, the sector began to fall sharply, then fell for the first time in at least seven years, according to Euromonitor data.

By the time the tariffs were imposed, home sales had slowed and some furniture companies were already struggling to stay afloat and unable to cope with the sudden increase in fixed costs.

American Signature Furniture, the parent company of Value City Furniture, declared bankruptcy late last year after nearly 80 years in business. The company launched liquidation sales at its remaining 89 stores last month.

The company said in a court filing that sales fell 27% from 2023 to 2025 due to the fallout from the COVID-19 pandemic, subsequent changes in consumer spending, and rising costs. It said its net operating loss for the period rose from $18 million to $70 million.

The company said in a filing that by the end of 2024, the company faced “significant liquidity constraints,” which were then “further exacerbated and accelerated by the introduction of new tariff policies.”

At least 10 other furniture companies declared bankruptcy last year, some liquidating and shutting down operations entirely, according to a CNBC review of federal bankruptcy filings.

Most of the companies are small and medium-sized, with fewer resources than their larger competitors, making them hit even harder by tariffs.

“Small businesses are definitely going to be hit the hardest because they don’t necessarily have deep pockets, they don’t have economies of scale, they don’t have large procurement teams that can suddenly change the destination or origin of goods,” said Neil Saunders, retail analyst and managing director at GlobalData. “So they’re under a lot of pressure and we’re probably going to see more failures in that independent space.”

Joseph Cozza’s small furniture business, East Coast Innovators, supplies retailers such as: Macy’s Raymore & Flannigan told CNBC it was forced to raise prices by 15% to 18% to offset higher tariff costs, leading to a drop in demand over the holidays.

For now, Cozza said he’s able to keep his business afloat, but he’s hopeful that lower interest rates, a shock to the housing market and better-than-expected tax returns will boost sales.

“I pray for it,” he said.

Otherwise, he said, the company may have to move its operations from Philadelphia to North Carolina, where operating costs are lower.

“I run a great company with great employees, and I pay them all very well, and yet I’m being penalized,” Cozza said. “I’m being punished for my actions, and I don’t think it’s fair.”

Gain market share

The advent of tariffs created market capture opportunities for large companies, which were better able than smaller companies to weather policy changes and keep prices low.

Over the past year, some large publicly traded furniture companies have actually increased profits and sales despite higher costs due to tariffs.

During IKEA’s fiscal year 2025, prices were relatively stable and revenues were able to remain roughly flat compared to 2024, it said in a news release. It reported an increase in operating expenses, but attributed the increase to acquisitions in the Baltic states rather than tariffs.

R.H., williams sonoma and wayfair All companies have grown sales and profits despite facing rising import costs.

For the nine months ended November 1, RH saw sales increase by nearly 10% as profit margins expanded. At Williams-Sonoma, sales rose about 4% in the 39 weeks that ended Nov. 2, and operating margins increased slightly. Wayfair, which reported fourth-quarter results on Thursday, reported a 5.1% increase in fiscal 2025 sales as gross margins stabilized and operating expenses decreased.

Wall Street still doesn’t know the full impact of furniture-specific tariffs on these companies, since most companies last reported results around the time the tariffs went into effect.

But they already face wide-ranging tariffs through 2025. Most of the United States’ furniture imports come from China, Vietnam, and other parts of Southeast Asia, and have been subject to various high tariffs even before furniture-specific taxes were introduced. At one point, imports from China were subject to tariffs of up to 145%, and Vietnam also faced tariffs of about 20%.

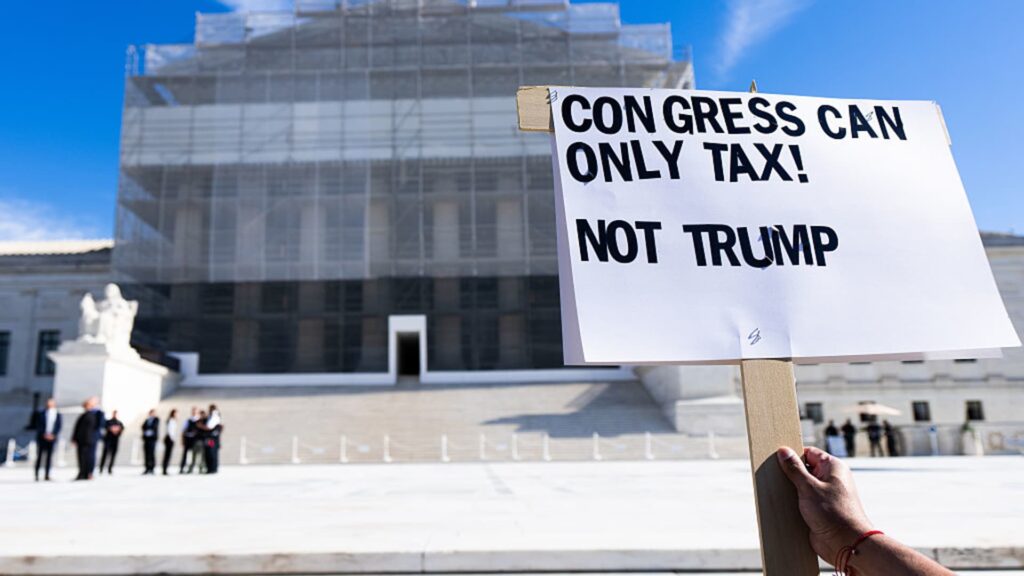

Most of these state-specific obligations have been considered by the Supreme Court. At the heart of the case is whether Mr. Trump had the legal authority to impose what he calls reciprocal tariffs, which critics argue violates Congress’ taxing power.

Whatever the court rules, it could create further uncertainty for the industry.

If the justices rule against the tariffs, there will be questions about how the tariffs will be returned and whether the administration will come up with new ways to implement them. If the judge rules in Mr. Trump’s favor, there will be questions about whether tariffs will be increased further.

“The CEO of one of the nation’s largest furniture retailers said to me, ‘Even if my pricing strategy turned out to be the worst for my business, I would create a plan, invest in that plan, and execute on that plan to produce the best possible results,'” said Teran of the Home Furnishings Association.

“Nobody can do that,” he said. “No one can invest in the plan right now because the tariff strategy is not stable. It continues to change and will almost certainly trigger changes after the impending Supreme Court decision.”