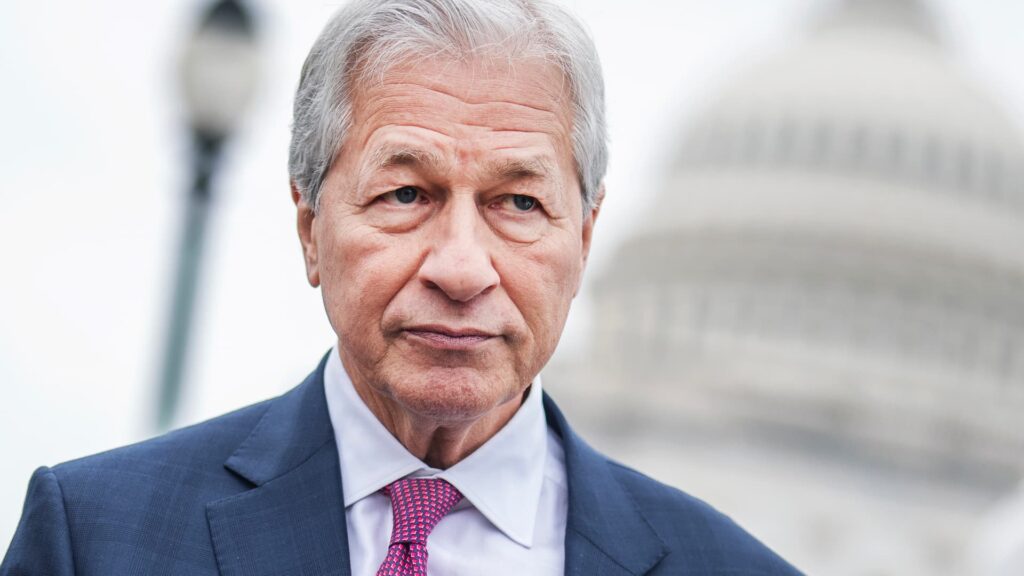

Jamie Dimon, CEO of JPMorgan Chase, will leave the U.S. Capitol on February 13, 2025 after meeting with Republicans from the Senate Bank, Housing and Urban Affairs Committee on the issue of withdrawal.

Tom Williams | CQ-Roll Call, Inc. |Getty Images

jpmorgan chain CEO Jamie Dimon says he doesn’t get the appeal of Stablecoins, but he can’t afford to stay on the sidelines either.

That’s the message Dimon gave on Tuesday when asked during a revenue conference call about whether his company, the largest and most influential US bank, is exploring payment techniques.

Stablecoins, as the name suggests, are a type of cryptocurrency designed to maintain stable value that is usually fixed in Fiat currencies, such as the US dollar. Last month, JPMorgan announced that it would be unveiling a more limited version of Stablecoin that only the JPMorgan client works. True Stablecoin is probably more universally accepted.

“We’re going to get involved in both JP Morgan Sediment Coins and Stubcoins to get it,” Dimon said. “I think they’re real, but I don’t know why you want to [use a] Stablecoin in contrast to just payment. ”

Dimon, 69, is one of the most vocal opponents of certain cryptocurrencies, such as Bitcoin. However, his bank is a juggernaut of the global payments industry and helps him travel nearly $10 trillion a day, so it makes sense to explore stubcoins when the technology regulatory framework is opened.

Otherwise, they could give the ground to fintech players trying to replicate elements of the regulated financial ecosystem, Dimon said Tuesday.

“You know, these guys are very smart,” Dimon said of his Fintech competitors. “They are trying to find ways to create a bank account and participate in payment systems and reward programs. We have to recognize that, and the way we recognize is to get involved.”

Citigroup, Bofacoin?

Stablecoins can potentially offer faster and cheaper payments than traditional bank rails, including ACH and Swift.

Citigroup Executives said Tuesday that the bank is “considering issuing City stub coins” among several ways to play in the space. The biggest opportunity is to provide tokenized deposits and custody of crypto assets, they said.

Bank of America CEO Brian Moynihan also says his company will be involved in Stablecoins.

One way is for traditional banks to cooperate through jointly owned early warning services. It is similar to how they united together to provide Zel for immediate peer-to-peer payments as a way to protect the lawn PayPal and block’S Cash app.

When asked about possible collaboration between banks on Tuesday, Dimon refused to give a specific answer.

“It’s a great question and we’ll leave it as a question,” Dimon said. “You can assume we’re thinking about it.”

Report from CNBC’s Jesse Pound