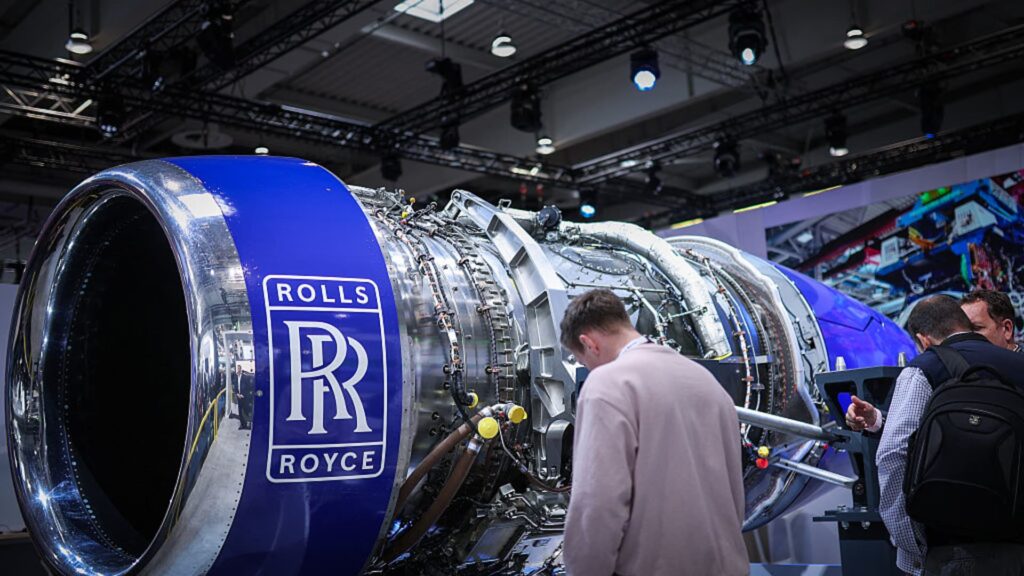

Rolls-Royce aircraft engines on display at the Hannover Messe industry fair on March 31, 2025.

Ronnie Hartman AFP | Getty Images

rolls royce Aerospace and defense companies have benefited from a wide range of factors, from defense operations to thriving power systems businesses to broader sectors, which has pushed their stock prices to new highs every business day this year. FTSE100 Larry.

The company’s recent broad theme has been around defense, which has dominated the stock price, leading to an almost 1,200% rise over the past five years.

The stock rose as much as 1.2% in early trading, building on a 10% rise in 2026, but remains behind other European defense stocks. line metal, leonardoserve, BAE Systems As geopolitical tensions disrupt markets.

In early 2026, the United States carried out a large-scale attack on Venezuela and captured its leader, Nicolas Maduro, followed by talk that President Donald Trump wanted to take control of Greenland, leading to a big movement in defense-related stocks.

But Rolls-Royce is more than just a defense company. The company’s defense business accounts for only about 25% of its underlying revenue, and its last reported half-year results showed little year-over-year growth.

Rolls-Royce stock continued its multi-year rally in 2026.

“Interestingly, in the short term, [defense] “It’s not our defense business where we’re seeing growth, it’s actually our power systems business, which has government cycles, where we have a leadership position in land and sea defense, and those tend to work on shorter cycles,” CFO Helen McCabe told CNBC’s “Squawk Box Europe” in July.

The company’s power systems division, which makes engines for ships and submarines, also has a data center business, and McCabe said orders were up 85% from a year ago and “there is huge potential.”

Rolls-Royce’s largest profitable business, Civil Aerospace, manufactures jet engines for commercial aircraft, including: boeing and airbusUBS analyst Ian Douglas Pennant on Friday raised his price target on the stock to 1,625 pence from 1,350 pence, saying: “This is a long-term turnaround story.”

Douglas Pennant said the price target increase was due to the company’s 2028 power generation sales growth forecast being raised to 26% from 20% from 2024 to 2028, citing rising data center sales.

He added that the increased sales outlook could increase the power business’s profitability (earnings before interest and taxes, EBIT) by up to 60% by 2028.

Rolls-Royce has a start-up business in energy generation, and in June received government support to build Britain’s first small modular nuclear reactor.

One potential concern for investors is that the stock price has soared, giving the company a trailing 12-month price-to-earnings ratio of more than 36 times, a higher valuation than its peers, according to LSEG.

Investors are now focused on the company’s full-year results, scheduled for February 26th, and are closely monitoring news regarding its upcoming share repurchase program, which will be announced in December.

— CNBC’s Sam Meredith contributed to this report