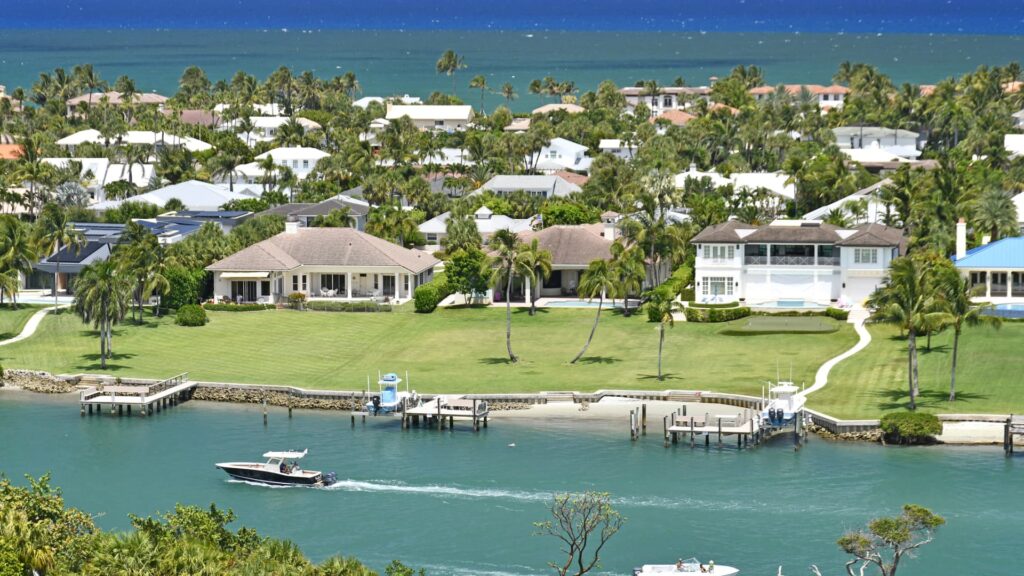

Views of gorgeous waterfront homes and boats along the incoastal waterways near Jupiter’s Inlet in Palm Beach County

Ryan Tishken | istock | Getty Images

This version of the article first appeared on CNBC’s Inside Wealth Newsletter. This is Robert Frank, our weekly guide to Net-Worth Investor and Consumer. Sign up to receive future editions directly in your inbox.

According to a new report from Brakerage Coldwell Banker, economic uncertainty is creating a gap in the luxury real estate market between ultra-rich buyers and merely wealthy people.

A survey of roughly 200 agents specializing in luxury real estate found that ultra-rich buyers, defined as individuals worth at least $30 million, still make expensive purchases despite fears of a trade war and recession. They are also driving a significant increase in total cash offers. Meanwhile, the report shows that wealthy but wealthy buyers are more sensitive to interest rates and are more cautious.

More than half of the agents surveyed said they saw a slight or significant increase in cash purchases by clients in 2025. Only 3.9% reported a decline in these buyers in the first five months of 2025, with 45.4% saying their cash purchases had been stable, according to the report.

Jason Waugh, president of Coldwell Banker Affiliates, told Inside Wealth that high interest rates are a major factor in the surge.

“Cash gives the buyers control. It offers leverage, speed and security,” he said. “But it’s a really high borrowing cost and it remains very high. Why absorb these costs when there’s cash to close out on the purchase of real estate?”

War, who obtained his broker license nearly 32 years ago, said that real estate could become attractive during times of economic uncertainty. More than two-thirds of the agents surveyed reported that wealthy clients were maintaining or increasing their real estate exposure, while only 11.3% said their clients’ profits had declined in favor of stocks and other financial assets. The remaining 20.6% of agents said their clients had put on hold on plans due to economic or stock market uncertainty.

“It’s a roller coaster, business is cyclical. At the end of the day, I think real estate is a tough asset that can sustain wealth and a hedge against inflation,” he said. “I think this data really confirms the story of how people see real estate as a great way to accumulate wealth, even in the most uncertain and unstable economic environment we’ve navigated over a decade.”

That said, luxury home sales rose overall in the first five months of 2025, but they hit in May, the first month after the stock market dip in April. The report said high-end single-family home sales fell 4.7% year-on-year, while real estate sales fell 21.1%, citing data from the Institute of Luxury Housing Marketing.

According to Waugh, the agent is also seeing more clients lower the price on their list in 2025 compared to 2025. According to the Luxury Home Marketing Institute, the median luxury single-family home and luxury single-family home sales prices and luxury materials sales prices are $1.7 million and $1.25 million, respectively.

War added that buyers in all price ranges are more discerning than they were a few years ago. They are currently looking for top-end appliances, from fireplaces to the entire kitchen, including smart fridges, spa-level amenities and indoor and outdoor living features.

First-time high-end buyers have particular options, he said.

“Given the current rate environment, they may be stretching themselves, so they will identify more in terms of assessing where they live, their amenities and the status of their property when they travel,” he said. “This year is a completely new environment than the previous few years.”