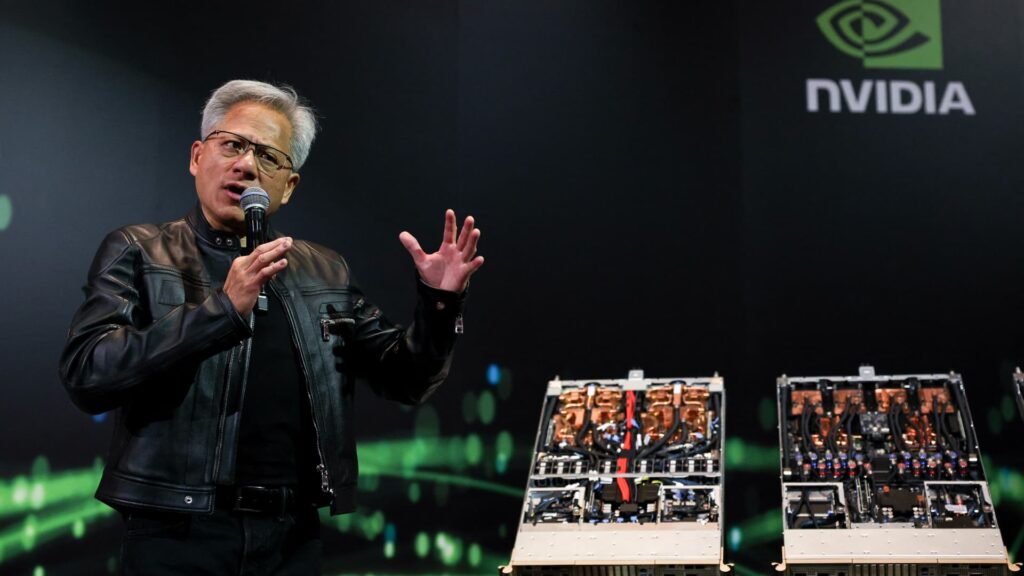

My top 101 to see on Wednesday, June 25th. The best watch of Nvidia’s history today. The AI chip giant stock closed at $147.90 yesterday, with a record of less than $149.43 on January 6th at under $2. We will be discussing the remaining portfolios of Nvidia and the club at our monthly meeting at noon ET. The Nvidia shareholders meeting is also today. 2. LoopCapital has raised Nvidia’s price target from $175 to $250 per share. That means an incredible $6 trillion market capitalization. Analysts said that by 2028 there will be $2 trillion in generated AI calculation spending, which could enter the “golden wave” of AI. 3. After yesterday’s rally, Wall Street was on track this morning for a calm opening. It also receives the highest surveillance of the S&P 500 ever. Oil rose modestly in the three-day winning streak. 4. FedEx has not been so disappointing in the business-to-consumer aspect, but it remains business-to-business-to-business. Things seemed to get better, but the “Day of Liberation” tariffs smoked B2B life. Barclays has cut its price target from $10 to $320, but still likes its cost-cutting strategy. 5. JPMorgan has upgraded its Taco Bell Parent Yum brand to an overweight purchase rating. Inside the restaurant, we own a Texas Roadhouse for the club. 6. Kraft Heinz has upgraded from cell to neutral at Goldman Sachs, with analysts claiming that risk/reward is more balanced. Goldman said that while scanner trends are still worsening, there is real value for the well-known craft brand. Craft’s leadership seems highly motivated and I love that at last we have some common sense brand expansions. 7. Barclays said after a pounding quarter with the cruise operator’s intense macro, the wind should remain on the back of the carnival. Analysts raised their price target from $30 to $33 per share. Carnival has expressed a confident tone 8. A beloved speculative play in a small reactor, Nuscaré has been downgraded by BTIG after its share price has more than doubled since earnings in mid-May. Nuscale received regulatory design approval later last month. Stocks fell nearly 3% this morning. 9. Citigroup is featured in a bullish memo about the oral obesity pill of the club’s name, Elilily, and the role that the direct consumer platform can play in reaching sales possibilities. Many people will want to switch from the current injectable GLP-1. 10. The club name Microsoft picked up price target bumps with Wedbush Securities and Wells Fargo. Wedbush went from $515 to $600 per share. Microsoft’s AI business could generate $100 billion in revenue by fiscal 2029. Jim waits 45 minutes after sending a trade alert before purchasing or selling stocks in the Charitable Trust portfolio. If Jim talks about stocks on CNBC TV, he will wait 72 hours after issuing a trade alert before running the trade. The above investment club information is subject to our Terms of Use and Privacy Policy, along with the disclaimer. Due to receiving information provided in connection with the Investment Club, there is no obligation or obligation of the fiduciary. No specific outcomes or benefits are guaranteed.